Ethereum 2.0 Staking: Validator Rehberi ve Mühendislik Notları

Ethereum'un Proof of Stake (PoS) geçişi sonrası validator kurulumu, ödül mekanizmaları, slashing riskleri ve bir senior mühendis gözüyle staking stratejileri.

“The Merge” Sonrası Yeni Bir Dönem: Neden Staking?

Ethereum dünyasında 15 Eylül 2022 tarihini unutmak mümkün değil. “The Merge” ile birlikte yıllardır beklenen Proof of Stake (PoS) geçişi gerçekleştiğinde, sadece enerji tüketimi %99.95 azalmadı; aynı zamanda ağın güvenliğini sağlama biçimi de kökten değişti. Eskiden devasa GPU çiftliklerine ve elektrik faturalarına ihtiyaç duyarken, artık “stake” edilen ETH’lerin (ekonomik teminatın) gücüyle bloklar doğrulanıyor.

Bir mühendis olarak bu değişimi bir “engine swap” (motor değişimi) olarak görüyorum. Giden, gürültülü ve verimsiz bir içten yanmalı motor; gelen ise sessiz, yüksek verimli ve deterministik bir elektrikli motor. Ama bu motoru çalıştırmak da her babayiğidin harcı değil. 32 ETH’lik giriş bariyeri ve teknik kurulum zorlukları, staking’i sadece bir pasif gelir yöntemi olmaktan çıkarıp bir sorumluluk haline getiriyor.

Validator performansınızı en üst düzeye çıkarmak için Solidity Akıllı Kontratlarında Gas Optimizasyonu prensiplerini de anlamak, ağın genel verimliliğine hakim olmanızı sağlar.

Beacon Chain ve Validator Yaşam Dönemi

Staking sisteminin kalbinde Beacon Chain yatıyor. Beacon Chain, shard’lar ve validator’lar arasındaki koordinasyonu sağlayan ana orkestra şefi. Bir validator’ın yaşam döngüsü, deposit kontratına 32 ETH yatırılmasıyla başlar.

Yukarıdaki diyagramda görebileceğiniz gibi, bir validator sadece “aktif” veya “pasif” değildir. Aktivasyon kuyruğuna girdiğiniz andan itibaren ağın bir parçası olursunuz. Kuyrukta beklemek bazen haftalar sürebilir; bu da ağın stabilitesini korumak için tasarlanmış bir “rate limiting” mekanizmasıdır. Eğer binlerce validator aynı anda ağa girseydi, Beacon Chain’in finality süresi tehlikeye girebilirdi.

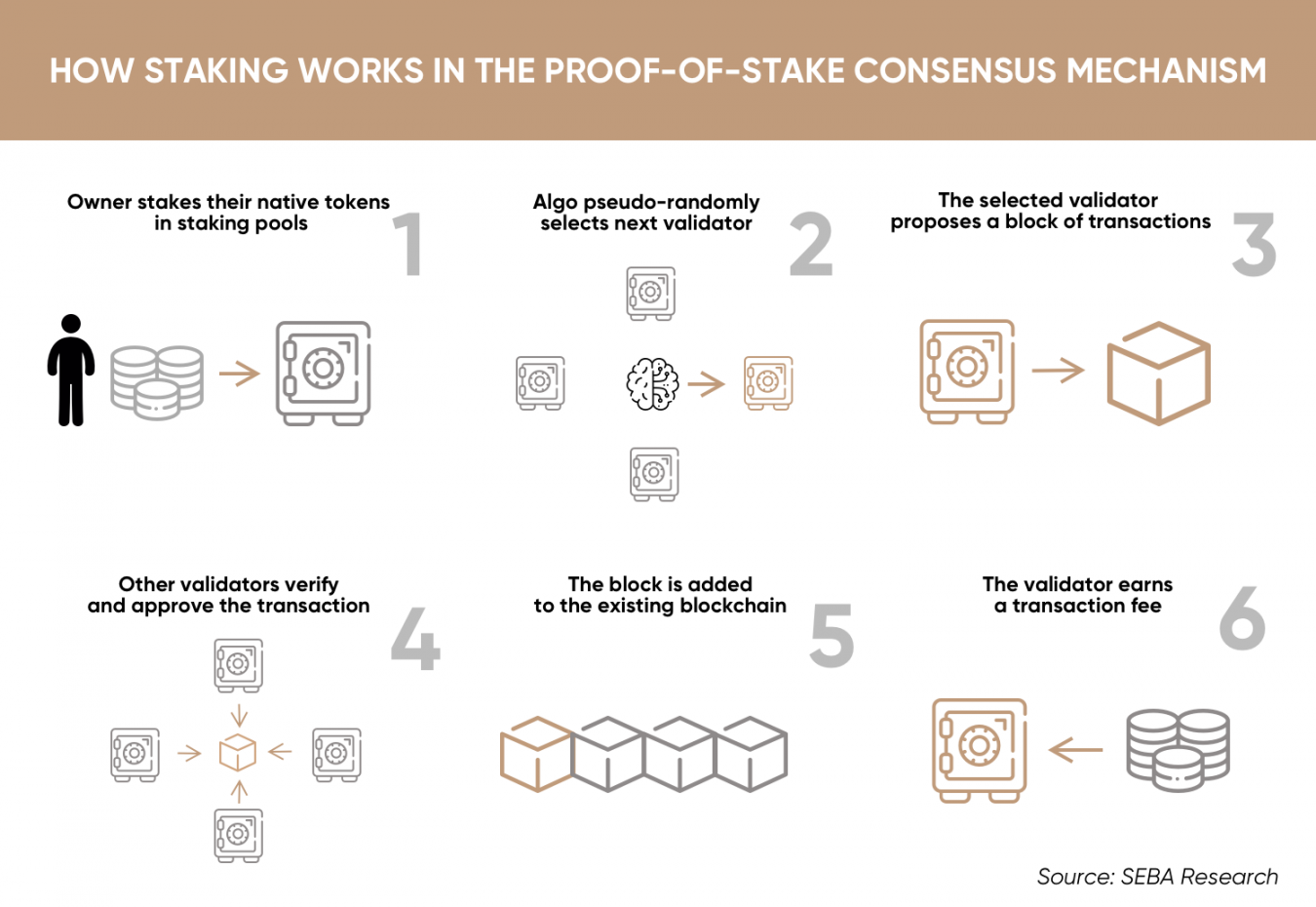

Mühendislik Gözüyle PoS Konsensüsü

Ethereum’un PoS mekanizması, sadece “parası olan konuşur” demek değildir. Aslında arkasında sofistike bir komite ve attestation yapısı barındırır. Her 12 saniyede bir (slot), bir validator blok üretmek için seçilir (proposer). Diğer validator’lar ise bu bloğu ve ağın genel durumunu doğrular (attestation).

Zaman Kavramı ve Matematik: Ethereum’da zaman Slot ve Epochlara bölünmüştür. Her bir slot 12 saniye sürer. 32 slot bir araya gelerek bir Epoch oluşturur.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

# Beacon Chain zaman hesaplama mantığı

import time

GENESIS_TIME = 1606824023 # 1 Aralık 2020

SECONDS_PER_SLOT = 12

SLOTS_PER_EPOCH = 32

def get_current_epoch():

elapsed = int(time.time()) - GENESIS_TIME

current_slot = elapsed // SECONDS_PER_SLOT

return current_slot // SLOTS_PER_EPOCH

def get_seconds_to_next_epoch():

elapsed = int(time.time()) - GENESIS_TIME

next_epoch_start = ((elapsed // (SECONDS_PER_SLOT * SLOTS_PER_EPOCH)) + 1) * (SECONDS_PER_SLOT * SLOTS_PER_EPOCH)

return next_epoch_start - elapsed

print(f"Şu anki Epoch: {get_current_epoch()}")

print(f"Sıradaki Epoch'a kalan süre: {get_seconds_to_next_epoch()} saniye")

Burada dikkat edilmesi gereken nokta, her epoch sonunda gerçekleşen “Finality” (Kesinleşme) sürecidir. Casper FFG protokolü sayesinde, validator’ların 2/3’ü bir epoch üzerinde uzlaştığında, o bloklar “finalized” (geri alınamaz) hale gelir.

Donanım ve Teknik Gereksinimler

Bir Ethereum validator node’u çalıştırmak, Solana kadar canavarca donanım istemese de hafife alınacak bir iş değildir. Node’un 7/24 internete bağlı ve senkronize kalması gerekir.

İdeal Bir Setup Karşılaştırması:

| Bileşen | Minimum | Önerilen (Senior Setup) |

|---|---|---|

| CPU | 4 Core | 8 Core (Ryzen 7 / i7) |

| RAM | 16 GB | 32 GB DDR4/DDR5 |

| Disk | 2 TB SATA SSD | 4 TB NVMe SSD (Gen4) |

| Ağ | 10 Mbps | 1 Gbps (Simetrik Fiber) |

| OS | Ubuntu 22.04 LTS | Ubuntu 24.04 LTS (Statik IP) |

Pratikte çoğu mühendis evde bir NUC (Intel Next Unit of Computing) veya benzeri bir “mini PC” üzerine Ubuntu kurarak bu işe başlar. Cloud kullanmak kârınızı eritebilir.

Karanlık Taraf: Penalties ve Slashing Riskleri

Her şey gül bahçesi değil. PoS sisteminde dürüst olmayan veya dikkatsiz davranan validator’lar cezalandırılır.

- Inactivity Leak: Eğer node’unuz çevrimdışı kalırsa, kazandığınız ödüller kadar bakiyenizden düşülür.

- Slashing: İşte bu gerçek bir kabustur. Eğer aynı anda iki farklı bloğa oy verirseniz bakiyenizin ciddi bir kısmı silinir.

Mühendislik Tavsiyesi: Slashing’den korunmanın en iyi yolu “redundancy” tuzağına düşmemektir. “Daha güvenli olsun diye iki node kurayım” derseniz, iki node aynı anda aynı anahtarla oy kullanır ve saniyeler içinde “slashed” olursunuz.

Kurulum Adımları: Lighthouse ve Geth

Bir mühendis olarak terminale hükmetmeyi seviyoruz. İşte Ubuntu üzerinde bir validator seti kurmanın temel komutları:

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

# 1. Geth (Execution Client) Kurulumu

sudo add-apt-repository -y ppa:ethereum/ethereum

sudo apt update

sudo apt install ethereum

# 2. Lighthouse (Consensus Client) İndirme

wget https://github.com/sigp/lighthouse/releases/download/v5.0.0/lighthouse-v5.0.0-x86_64-unknown-linux-gnu.tar.gz

tar -xvf lighthouse-v5.0.0-x86_64-unknown-linux-gnu.tar.gz

sudo mv lighthouse /usr/local/bin

# 3. JWT Secret Oluşturma (İki client'ın konuşması için)

openssl rand -hex 32 > /var/lib/ethereum/jwt.hex

# 4. Geth Servisini Başlatma

# --authrpc.jwtsecret parametresi kritik önem taşır

geth --mainnet --http --authrpc.jwtsecret /var/lib/ethereum/jwt.hex

Bu adımları tamamladıktan sonra beacon node ve validator client servislerini de sistemd üzerinden yönetmek en sağlıklı yaklaşımdır.

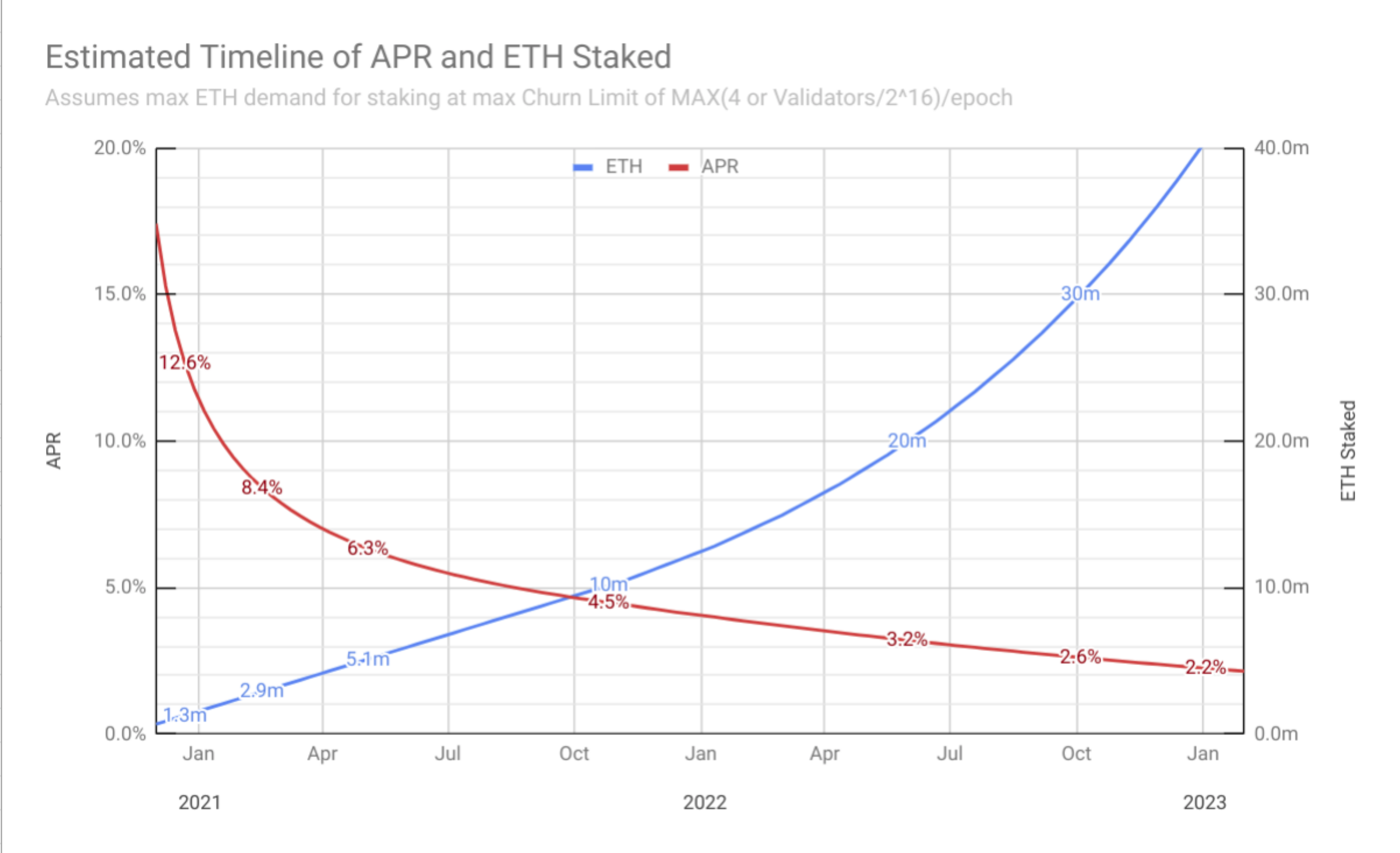

Kazanç Hesaplama: APR ve Ödül Kaynakları

Staking bir yatırım aracı olarak görüldüğünde, en çok merak edilen soru: “Ne kadar kazanırım?” oluyor.

- Issuance (Emisyon): Ağın yeni ürettiği ETH’ler.

- Priority Fees (İşlem İpuçları): Kullanıcıların ödediği işlem ücretleri.

- MEV (Maximal Extractable Value): Blok içi optimizasyon geliri.

Şu anki piyasa koşullarında staking APR’ı %3 ila %5 arasında seyrediyor. Eğer MEV-Boost gibi araçları node’unuza entegre ederseniz, bu oranı yukarı çekebilirsiniz.

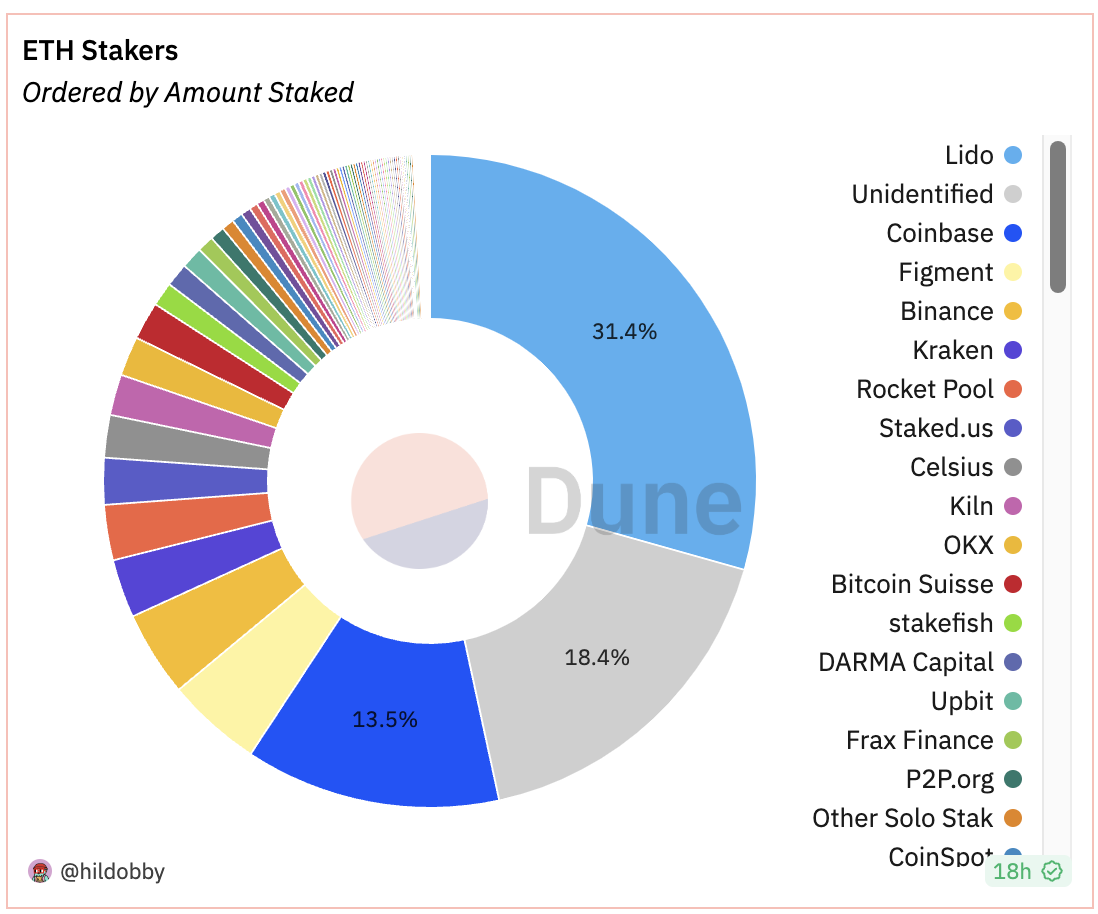

Staking Yöntemleri: Solo mu, Havuz mu?

Ethereum ekosistemi herkese uygun çözümler sunar:

- Solo Staking: 32 ETH’nizi kendi makinenizde kilitlersiniz. Maksimum kâr, tam kontrol.

- Liquid Staking (Lido, Rocket Pool): 0.01 ETH ile başlanabilir. stETH veya rETH alırsınız. Teknik bilgi gerektirmez.

Kendi projelerimde genellikle Rocket Pool’u tercih ediyorum çünkü merkeziyetsizlik felsefesine en yakın duran havuz yapısı onlarda. Lido ise pazar hakimiyeti yüzünden eleştiriliyor.

İzleme ve Monitör Etme: Prometheus & Grafana

Validator’ın sağlığını takip etmek bir mühendislik zorunluluğudur. Node’un CPU sıcaklığı, RAM kullanımı ve attestation başarısı 7/24 izlenmelidir.

Neleri Takip Etmelisiniz?

- Peers Count: Beacon node’un kaç diğer node ile bağlı olduğu.

- Sync Status: Zincir ile uyumlu olup olmadığınız.

- Vote Success Rate: Attestation kaliteniz.

Prometheus üzerinden metrikleri toplayıp Grafana ile görselleştirmek, sabah kahvenizi içerken “node’um ne durumda?” sorusuna yanıt vermenizi sağlar.

Teknik Sözlük (Glossary)

- Attestation: Bir validator’ın bir bloka verdiği oylama mesajı.

- Committee: Bir slotta blokları doğrulamak için rastgele seçilen validator grubu.

- Deposit Contract: Staking için ETH’lerin yatırıldığı resmi akıllı kontrat.

- Execution Client: İşlemleri yürüten katman (Geth, Besu, Nethermind).

- Consensus Client: Blok uzlaşmasını sağlayan katman (Prysm, Lighthouse, Teku).

Staking Hakkında Doğru Bilinen Yanlışlar

- “ETH’lerim sonsuza kadar kilitli mi?”: Hayır, Shapella güncellemesi sonrası çekim yapabilirsiniz.

- “İnternetim 1 saniye giderse her şey biter mi?”: Hayır, sadece o süre zarfında ödül alamazsınız.

- “Güçlü bir ekran kartı mı lazım?”: Hayır, PoS donanım açısından mütevazıdır.

Gelecek Vizyonu: DVT ve Danksharding

Gelecek güncellemelerle birlikte Distributed Validator Technology (DVT) yaygınlaşacak. Bu teknoloji, bir validator anahtarının birden fazla node arasında paylaştırılmasını sağlayarak slashing riskini minimize edecek.

Ayrıca “Proto-Danksharding” (EIP-4844) ile birlikte ağın veri kapasitesi artacak, bu da staking dünyasını sadece bir para yatırma işlemi olmaktan çıkarıp devasa bir veri katmanı koruma yarışına dönüştürecektir.

Son Mühendislik Notları

Ethereum validator’ı olmak, sadece kâr odaklı bir iş değildir; ağın güvenliğini sağlayan bir “node operator” sorumluluğudur.

- Güvenlik: Mnemonics kağıtta kalmalı, dijital ortamdan uzak durmalı.

- Güncellik: Client güncellemelerini haftalık takip etmek şart.

- Motivasyon: Geleceğin finansal sistemini bir terminal ekranından izlemek muazzam bir keyif.

Staking, blockchain dünyasındaki en sürdürülebilir gelir modelidir. Kendi makinenizi kurup bu serüvene dahil olmak, bir mühendisin Web3 yolculuğundaki en değerli kilometre taşlarından biri olacaktır.